[ad_1]

Investing in stocks will also be a great way to broaden your worth vary. Although it has a very peak ceiling, it moreover has an attractive low floor: nowadays, all you need to start investing inside the stock market is just a few dollars and an Internet connection. In this article, I will be able to duvet the whole thing you need to be informed about learn how to earn a living in stocks, from the steps each and every newbie investor should take to further sophisticated strategies, along with the common mistakes you should keep away from.

Please understand that this article does not constitute investment advice and is posted for tutorial purposes best.

What Are Stocks?

Stocks represent shares of ownership in a company, making the stockholder an element owner of that business. When you buy individual stocks, you’re essentially buying a piece of that company’s long term source of revenue and expansion. The worth of the ones stocks, or stock prices, fluctuates consistent with how buyers perceive the company’s chances.

Companies issue stocks to spice up capital for expansion, new duties, or to toughen their financial neatly being. This process is a basic facet of the way the stock market functions, providing a platform where stocks are bought and acquired. Investing in stocks is considered probably the most primary methods for other people to broaden their wealth over time. Unlike other asset classes, corresponding to bonds or precise belongings, stocks have the opportunity of necessary expansion, alternatively moreover they come with higher likelihood on account of market volatility.

Types of Stocks

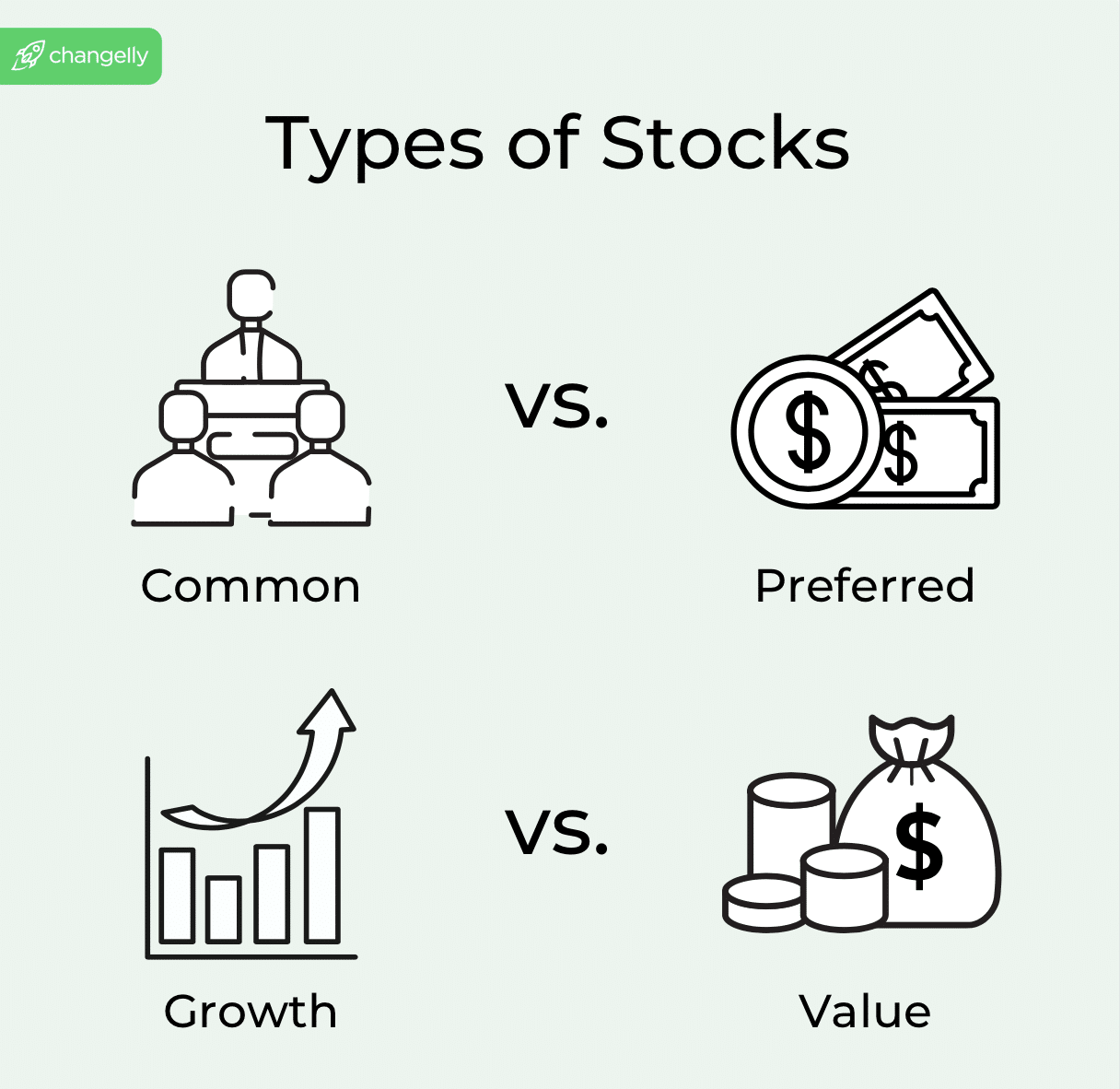

Stocks will also be widely labeled into two number one types: common stocks and most popular stocks. Common stocks are one of the most prevalent form of stock that individuals invest in. Holders of common stocks have voting rights at shareholders’ meetings and may download dividends, which may well be a percentage of the company’s source of revenue. Preferred stocks, then again, normally don’t provide voting rights, alternatively they supply a greater claim on belongings and source of revenue than common stocks; for example, dividends for most popular stocks are normally higher and paid out faster than those of common stocks.

Within the ones categories, stocks can also be categorised consistent with the company’s characteristics, corresponding to expansion stocks and value stocks. Growth stocks are from firms expected to broaden at an above-moderate worth compared to other firms. They reinvest their source of revenue into the business for expansion, so dividends are a lot much less common. Value stocks are those that buyers consider are undervalued by means of {the marketplace}. They are forever firms with solid fundamentals that, for reasonably numerous reasons, are purchasing and promoting underneath what buyers perceive to be their true market worth.

How to Start Investing in Stocks

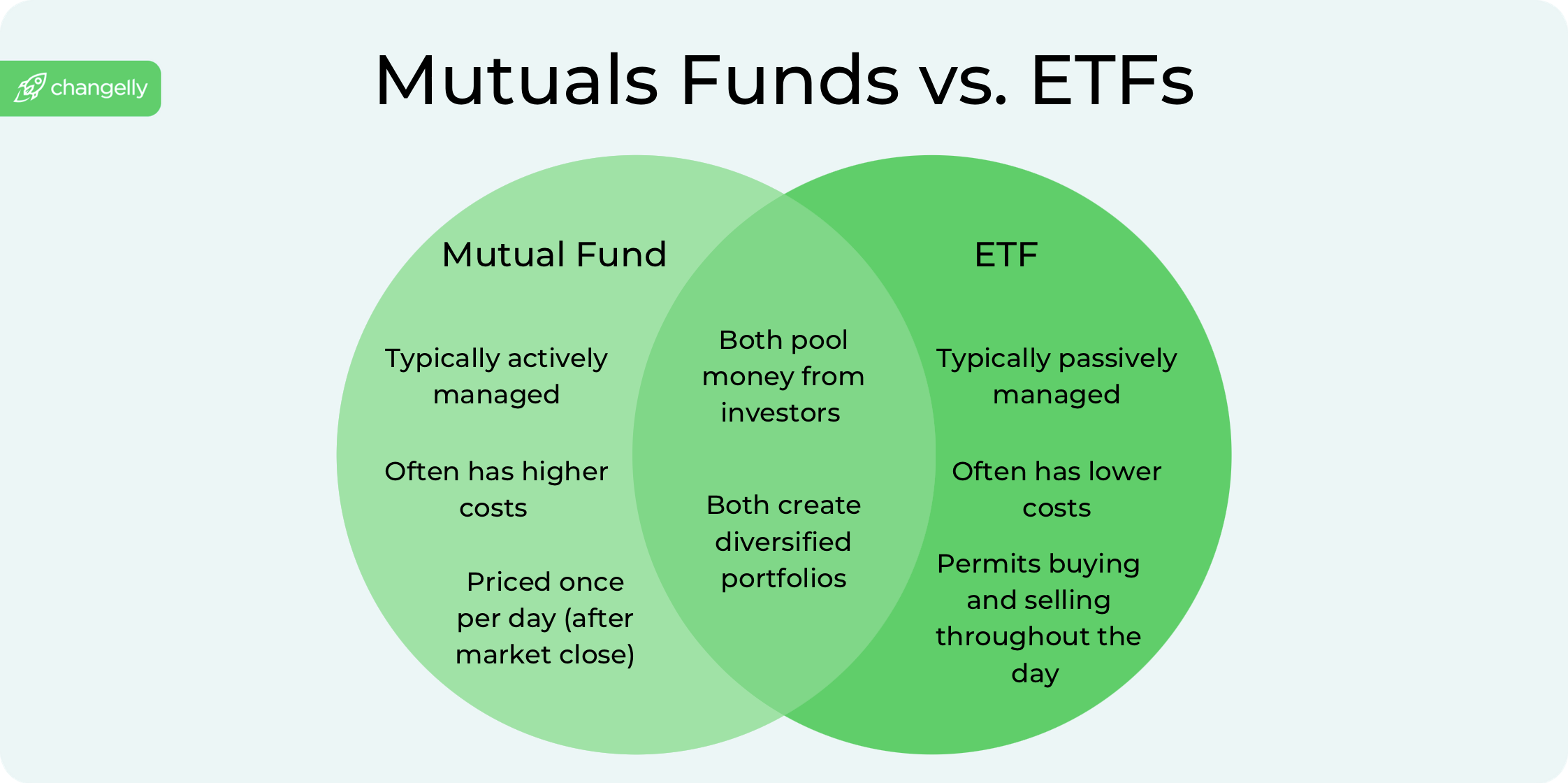

Starting your journey into stock investing can seem daunting to begin with, alternatively with the appropriate method, it can be an exhilarating technique to broaden your wealth. First, it’s crucial to remember that stocks are shares of ownership in individual firms. When you buy stocks, you’re hoping that the companies you invest in will broaden, increasing the value of your shares. Besides individual stocks, you’ll be able to moreover invest in mutual worth vary and alternate-traded worth vary (ETFs), which allow you to buy a basket of stocks in one achieve. This can have the same opinion diversify your portfolio and reduce likelihood.

Step 1: Define Your Investment Goals and Risk Tolerance

- Identify your financial goals: Are you saving for retirement, an area, or in all probability your child’s coaching? Your goals will have an effect on your investment methodology.

- Understand how so much likelihood you’re willing to take. Younger, lengthy-time duration buyers would in all probability tolerate further likelihood compared to those closer to retirement.

Step 2: Choose the Right Investment Account

- For most, a web based brokerage account is the best place to start. These platforms offer get admission to to reasonably numerous stocks, mutual worth vary, and ETFs.

- Consider starting with a tax-advantaged account like a standard IRA, in particular will have to you’re investing for retirement.

Step 3: Start With Mutual Funds or ETFs

- Mutual worth vary and ETFs offer fast diversification, which is crucial for decreasing likelihood. They mean you can invest in many stocks by means of purchasing a single percentage of the fund.

- Look for worth vary that observe all the market for a get began, as they tend to be further cast and have lower fees.

Step 4: Diversify Your Portfolio

- As you get further at ease, you’ll be able to get began together with individual stocks for your portfolio. Focus on industries and firms .

- Remember, a smartly-various portfolio comprises a mix of sectors and asset classes to mitigate likelihood further.

Step 5: Monitor and Adjust Your Portfolio

- Regularly review your portfolio to make sure it aligns in conjunction with your investment goals and likelihood tolerance.

- Be able to keep watch over your investments as your goals or {the marketplace} changes.

Investing in stocks is not just about opting for winners. It’s about atmosphere clear goals, understanding your likelihood tolerance, and frequently construction a assorted portfolio. While individual stocks may also be providing necessary returns, moreover they come with higher likelihood. Starting with mutual worth vary or ETFs can be a extra safe technique to get involved inside the stock market, in particular for beginners. Remember, investing is a marathon, not a touch; staying power and self-control are key to lengthy-time duration good fortune.

How to Invest inside the Stock Market

Investing inside the stock market involves a series of strategic actions aimed toward emerging your capital and achieving financial really helpful houses. Here are some commonplace guidelines and steps that can get you started to your investment journey.

Selecting Stocks and Stock Funds

- Choosing Individual Stocks: When you’re in a position to speculate, opting for individual firms requires research into their financial neatly being, market position, and conceivable for long term expansion. Look for companies with robust source of revenue expansion, solid keep watch over teams, and competitive advantages in their industry. Investing in individual stocks provides the opportunity of peak returns alternatively comes with higher likelihood.

- Investing in Stock Mutual Funds or ETFs: For those searching for diversification with a single transaction, stock mutual worth vary and ETFs are final. These worth vary pool money from many buyers to buy a portfolio of stocks. Index worth vary, which observe a selected index identical to the S&P 500, offer massive market exposure and are a favorite variety among lengthy-time duration buyers for their low fees and solid returns over time.

Making Your Investment

- Using an Online Brokerage Account: To buy shares of stock or stock worth vary, you’ll need an account with a web based broker. These platforms offer tools for research and purchasing and promoting, with assorted levels of beef up and prices. Some brokers moreover offer the selection to buy fractional shares, making it more uncomplicated to invest in top-priced stocks with a lot much less money.

- Placing Orders: You will have to buy stocks via assorted types of orders. A “market order” buys in an instant at the provide market price, while a “restrict order” devices a selected price at which you’re willing to buy. Understanding the ones possible choices helps you keep watch over your investment methodology further precisely.

- Portfolio Management: Once you’ve made your investments, managing your stock portfolio involves monitoring the potency of your stocks or worth vary, maintaining a tally of the market for changes, and adjusting your holdings as sought after. This may include selling underperformers or buying additional shares of a luck investments.

Reinvesting Dividends and Taking Advantage of Compound Interest

- Dividend Reinvestment: Many stocks and mutual worth vary distribute dividends, which you’ll be able to select to reinvest by means of purchasing additional shares. This compounding affect can significantly building up your investment returns over time.

Evaluating Performance and Adjusting Your Strategy

- Regularly review the potency of your investments in comparison to your goals and the broader market. Adjust your holdings to align in conjunction with your investment methodology, taking into account changes in market conditions, monetary indicators, and your financial goals.

Investing inside the stock market is a dynamic and engaging process. By actively settling on stocks or worth vary, the use of a web based brokerage platform for trades, managing your portfolio with an expert possible choices, and leveraging the power of compounding via dividend reinvestment, you put yourself to capitalize on the conceivable financial rewards the stock market provides. Remember, while the aim is to earn a living, understanding the hazards and maintaining a disciplined approach to investing is crucial for lengthy-time duration good fortune.

Making Money with Stocks: Advanced Strategies and Tips

Beyond the basics of settling on stocks and managing a portfolio, there are sophisticated strategies {that a} luck buyers use to increase their possibilities of earning money from stocks. These approaches remember market characteristics, company potency, and the broader monetary landscape to make an expert possible choices. Here are some strategies and guidelines that can assist you maximize your investment returns:

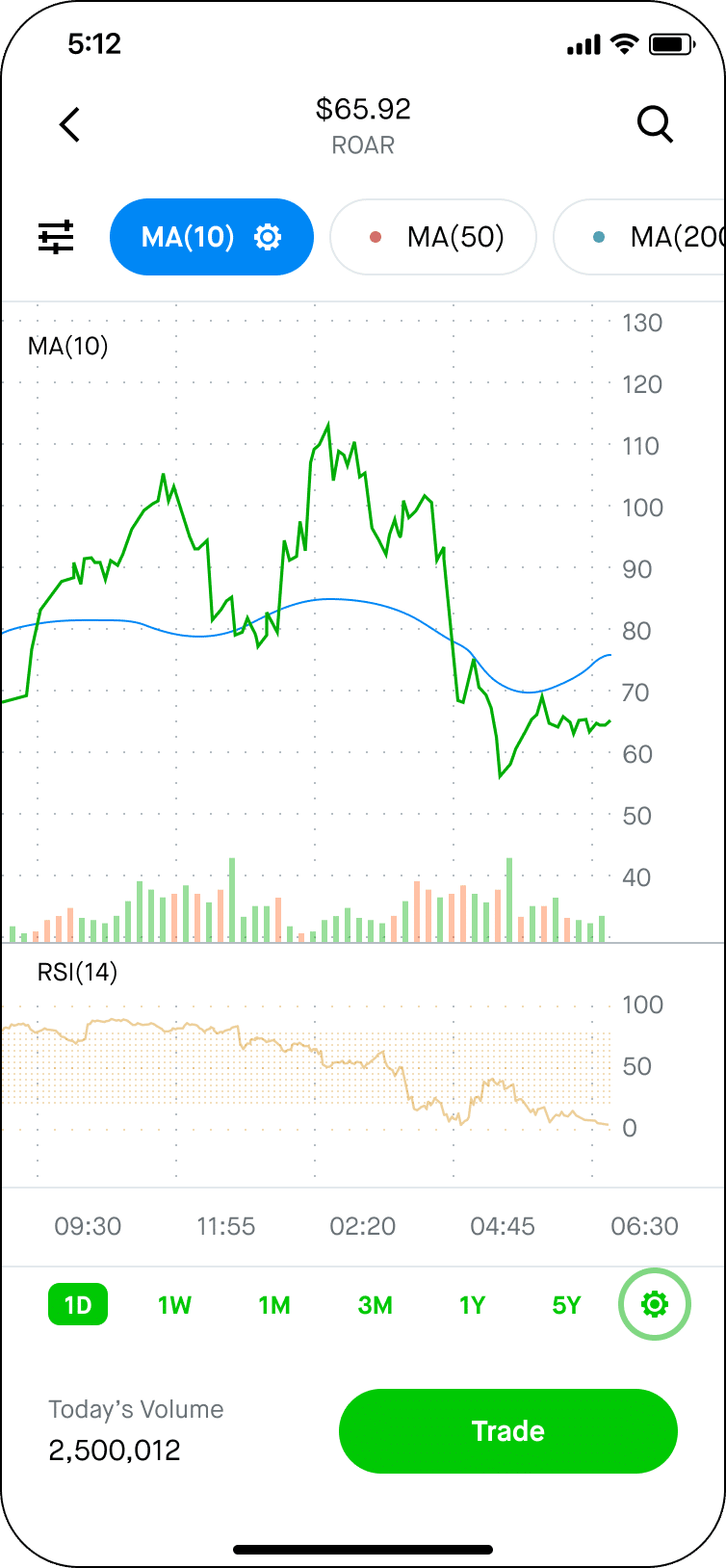

Understanding and Utilizing Stock Charts

Charts provide a visual representation of a stock’s earlier and supply potency, offering insights into conceivable long term movements. Look for patterns and characteristics that can indicate buying or selling choices. Use technical analysis to investigate stock charts to make predictions about long term price movements consistent with earlier potency. While not foolproof, it can be a great tool on your investment determination-making process.

Tax-Efficient Investing

Take advantage of tax benefits by way of the use of tax-advantaged accounts like IRAs and 401(good enough)s to minimize the tax have an effect on to your investment really helpful houses. Additionally, advertise underperforming stocks to know losses that can offset really helpful houses and reduce your tax felony accountability.

Try Different Investment Strategies

There are many assorted techniques to earn a living from stocks. For example, you’ll be able to consider the purchase-and-dangle methodology — a protracted-time duration investment methodology that comes to shopping for stocks and protecting onto them for a variety of years or a very long time, irrespective of market volatility. It’s consistent with the conclusion that the stock market will generate sure returns over time. You can also diversify your portfolio by means of investing in reasonably numerous sectors. This mean you can mitigate likelihood and capitalize on expansion in different areas of the monetary device. Another highway you’ll be able to division out into is IPOs — initial public possible choices and secondary possible choices may give choices for buyers. However, they may be able to also be unhealthy, so it’s crucial to research the ones choices utterly faster than investing.

Investing in Stocks: Extra Tips

- Review your investment methodology regularly, as your financial state of affairs and goals can exchange over time.

- Set and adjust your time horizon — your investment methodology should mirror the time period you propose to stay invested.

- Use prevent-loss orders to minimize conceivable losses.

- Rebalance your portfolio every year to take care of your desired asset allocation.

- Consider dividend reinvestment plans (DRIPs) to robotically reinvest dividends, compounding your investment returns.

- Keep an emergency fund to keep away from having to advertise stocks in a down market.

Common Mistakes to Avoid When Investing in Stocks

No subject whether or not or now not you’re a newbie stock broker or have been navigating the stock exchange for years, there are common mistakes that can impede your good fortune. By working out and warding off the ones errors, individual buyers can toughen their possibilities of earning money from stocks. Here are some an important missteps to watch out for:

- Chasing peak returns without taking into consideration additional likelihood: High returns forever come with peak likelihood. It’s essential to steadiness the lure of conceivable really helpful houses with the chance you’re willing to take, in particular with risky belongings like small-cap stocks.

- Ignoring the importance of diversification: Relying a great deal of on a single stock, sector, or asset elegance can divulge your investment portfolio to unnecessary likelihood. Diversifying all the way through reasonably numerous sectors, along side dividend stocks and stock mutual worth vary, can have the same opinion spread likelihood.

- Neglecting the investment’s time horizon: Your investment methodology should align in conjunction with your financial goals and the time period it is a should to achieve them. Short-term market fluctuations subject a lot much less for lengthy-time duration buyers, who can forever enjoy out volatility.

- Overreacting to brief-time duration market volatility: The stock market is inherently risky, and percentage prices fluctuate. Making hasty possible choices consistent with brief-time duration movements can jeopardize lengthy-time duration really helpful houses.

- Overlooking fees and expenses: Fees can eat into your returns over time. Pay attention to transaction fees, fund keep watch over fees, and other costs comparable in conjunction with your brokerage account (e.g., Charles Schwab, Vanguard).

- Attempting to time {the marketplace}: Trying to be expecting the best circumstances to buy and advertise is notoriously tough, even for professional buyers. A further unswerving methodology is not unusual, disciplined investing, irrespective of market conditions.

By being conscious about the ones common mistakes, individual buyers can take steps to keep away from them, making further an expert financial possible choices that align with their investment goals and likelihood tolerance. Remember, a luck investing requires a mix of diligence, staying power, and stable learning. Whether you’re investing in dividend stocks, exploring small-cap stocks, or construction a assorted portfolio with stock mutual worth vary, staying an expert and warding off the ones pitfalls mean you can navigate the complexities of the stock market further effectively.

FAQ: How to Make Money in Stocks

How do beginners earn a living inside the stock market?

Beginners can earn a living inside the stock market by means of starting with investment accounts that require low initial investments, corresponding to online brokers or robo-advisors. Investing in mutual worth vary or alternate-traded worth vary (ETFs) can also be a good get began, as they supply diversification with just a few dollars. Consulting a financial advisor for custom designed advice can further beef up investment possible choices.

Can you make a lot of money in stocks?

Yes, it’s possible to make a lot of money in stocks, in particular will have to you’re making investments correctly over a long duration. Successful stock investments forever include a mix of assorted belongings, staying power, and a smartly-researched methodology. However, the stock market moreover carries the chance of losses.

Can I make $100 a day with stocks?

Making $100 a day with stocks is possible alternatively extraordinarily variable and will depend on the amount of capital invested and market conditions. Such brief-time duration purchasing and promoting requires necessary knowledge, experience, and likelihood tolerance, as it forever involves speculative strategies.

How so much money do I want to invest to make $1,000 a month?

The amount needed to invest to make $1,000 a month will depend on the expected return worth. For example, to generate $12,000 every year with a 5% return, you would need to invest more or less $240,000. This calculation varies consistent with the return worth and does not account for taxes or fees.

What are the best brokers for stock purchasing and promoting?

The absolute best brokers for stock purchasing and promoting offer low fees, a consumer-pleasant platform, and quite a lot of investment possible choices. Popular choices include online brokers like Charles Schwab, Vanguard, and Fidelity. These platforms cater to each and every beginners and professional traders with reasonably numerous tools for wealth keep watch over and retirement accounts.

Is stock investing safe?

Stock investing involves likelihood, along side the conceivable loss of elementary. However, diversifying your investments all the way through different asset classes and sectors can mitigate some risks. It’s moreover extra safe to speculate with a protracted-time duration perspective fairly than searching for to make speedy source of revenue from brief-time duration market fluctuations. Consulting financial advisors for tailored advice can also have the same opinion navigate the hazards associated with stock investing.

Disclaimer: Please bear in mind that the contents of this article are not financial or investing advice. The wisdom provided in this article is the creator’s opinion best and should not be thought to be as offering purchasing and promoting or investing tips. We don’t seem to be making any warranties in regards to the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from peak volatility and low arbitrary movements. Any investor, broker, or not unusual crypto shoppers should research a couple of viewpoints and take note of all local laws faster than committing to an investment.

[ad_2]