[ad_1]

Are you a amateur who wants to find what the stock market has to offer or an professional broker taking a look to hunt out the best stock market app to take your purchasing and promoting journey to the next level? Then, you’ve come to the most productive place. In this text, I will tick list all of the best apps for stock purchasing and promoting and investing. Which one is your favorite?

What Is the Best Stock Market App?

Charles Schwab, Fidelity, and Interactive Brokers are all among the finest stock purchasing and promoting apps available on the market. All in all, however, there are a lot of great stock market apps and online brokers available out there for passive and full of life consumers alike.

No subject what kind of investments you favor, you’ll be able to to seek out something that can suit your wishes — the problem is finding stock purchasing and promoting apps which can be every unswerving and have great fees and low fees. Here are one of the most a very powerful best stock apps you get these days.

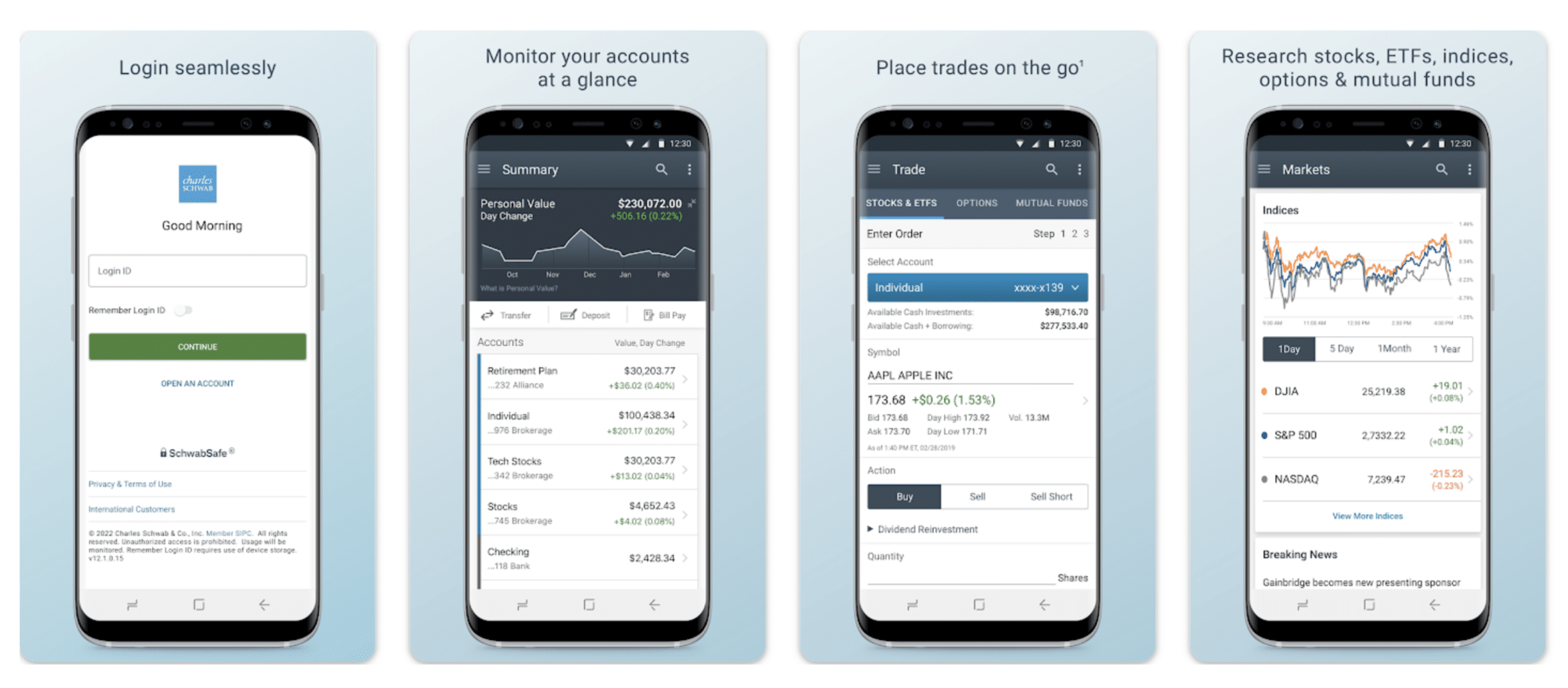

Charles Schwab

The Charles Schwab mobile purchasing and promoting app is extensively considered one of the most important best all-round possible choices for full of life consumers. As one of the revered and trusted online brokers within the commerce, it has earned a very good reputation that is also subsidized up throughout the choices and costs that it supplies.

In 2020, Charles Schwab were given TD Ameritrade, every other stylish purchasing and promoting platform that specialize in full of life purchasing and promoting (it supported futures purchasing and promoting, foreign currency echange, and crypto purchasing and promoting). As a finish end result, all TD Ameritrade user accounts had been moved to the Schwab platform.

Key Features

- Large Fund Selection: Features an unlimited array of finances with low expense ratios and no transaction fees.

- Advanced Trading Tools: Attracts full of life consumers with $0 commissions on stock and ETF trades.

- Educational Resources: Ideal for novices who need steerage on investment.

- Extensive Research: Offers every Schwab’s non-public equity rankings and Third-birthday party analyses.

Pros

- Offers 4 purchasing and promoting platforms without minimum fees.

- Great mobile app for purchasing and promoting on the cross.

- $0 fee: Charles Schwab supplies fee-loose purchasing and promoting on stocks and ETFs.

- Comprehensive research equipment for skilled purchasing and promoting picks.

- All forms of fee-loose stock, possible choices, and ETF trades.

Cons

- The low interest rate on uninvested cash might be a drawback for some shoppers.

Charles Schwab is suitable for every amateur investors looking for educational belongings and complex consumers on the lookout for delicate equipment and in depth research possible choices. It’s moreover a very good variety for those in gaining access to a wide array of finances without transaction fees.

At the time of writing, Charles Schwab moreover had the Schwab Investor Reward program, which supplies up to $2,500 when you open and fund an eligible account with a qualifying internet deposit of cash or securities.

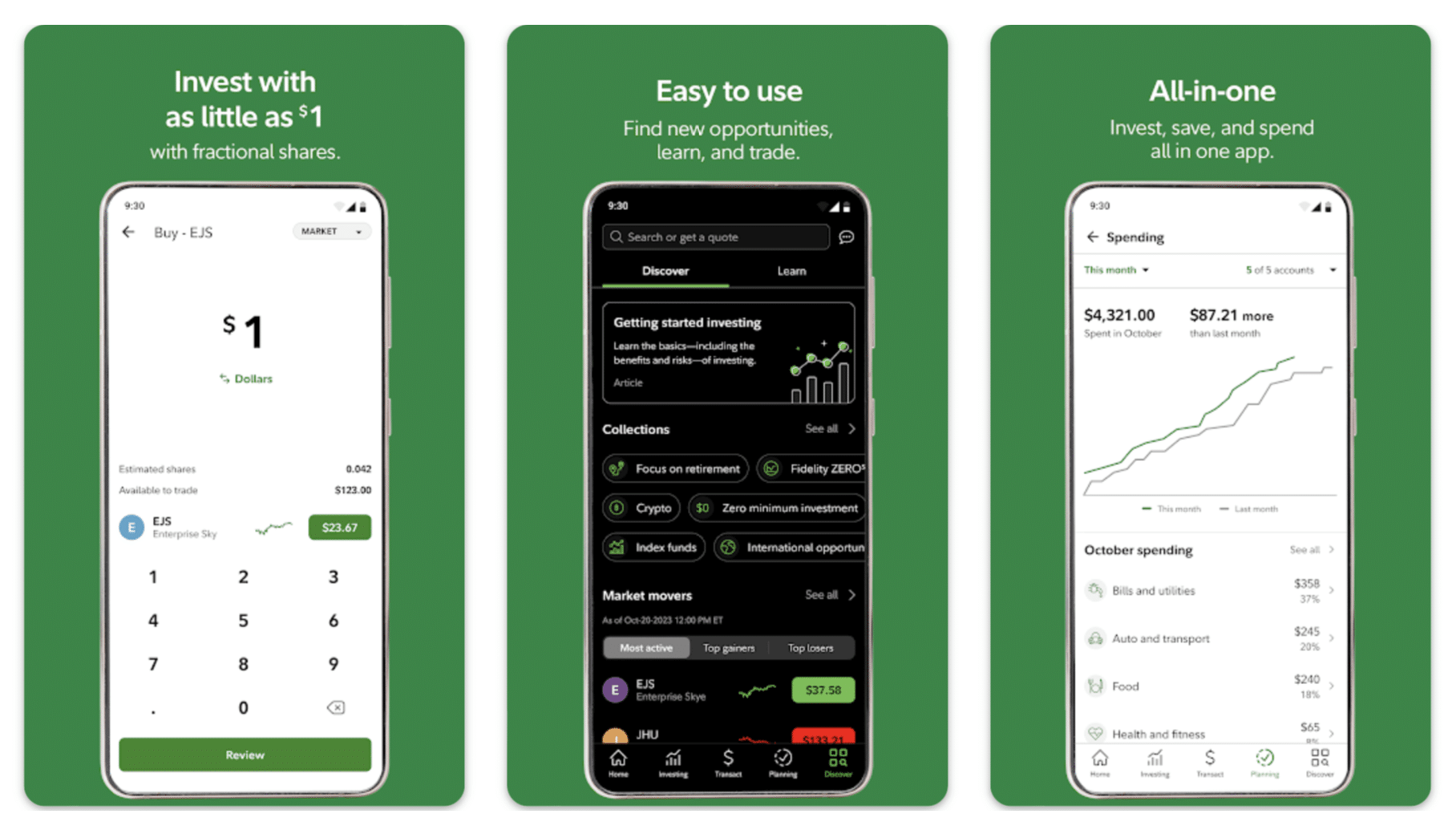

Fidelity

Fidelity is every other well known and revered purchasing and promoting platform that provides a wide variety of more than a few investment equipment. It stands proud for its whole suite of products and services and merchandise, tough research equipment, and strong purchaser beef up, making it a cast variety for investors of all levels of experience.

Key Features:

- Commission-Free Trades: Offers $0 purchasing and promoting commissions on stocks, trade-traded finances (ETFs), and possible choices.

- Research and Tools: Access to a large range of research providers and a best-notch mobile app and power.

- Customer Service: Known for tough buyer reinforce.

- Index Funds: Provides expense-ratio-loose index finances.

Pros:

- Large collection of more than 3,300 no-transaction-charge mutual finances.

- An very good mobile app with a major App Store rating that makes purchasing and promoting to be had and atmosphere pleasant.

- High interest rate on uninvested cash, in point of fact useful for cash keep watch over.

Cons:

- Broker-assisted business fees are on the higher aspect, which might be a consideration for consumers requiring personal assist.

Fidelity is very good for novices as a result of its whole belongings. Active investors may also respect its $0 commission trades and complex purchasing and promoting platform. Its in depth mutual fund possible choices and no-expense-ratio index finances make it a stupendous selection for lengthy-time length investors as well.

SoFi Invest

SoFi Invest is a stock purchasing and promoting app that stands out for its determination to providing a consumer-pleasant and whole purchasing and promoting experience, in particular for those new to investing. Its focal point on educational belongings and purchaser beef up further supplies to its appeal for novices.

Key Features:

- Commission-free trades: SoFi Invest supplies fee-loose trades on stocks, ETFs, and fractional shares.

- Good for all types of investors: The platform is praised for its consumer-friendliness and strong mobile app experience.

- Great investment selection: In addition to all of the standard possible choices, it moreover provides unique get entry to to IPOs, free financial counseling, and no account minimums.

- Mutual finances: In 2024, SoFi added mutual finances to its line-up, improving its appeal as a smartly-rounded investment platform.

Pros:

- No purchasing and promoting commissions and no account minimums make it to be had for novices.

- Offers fractional shares, allowing investment in prime-worth stocks with a lot much less capital.

- Access to free financial counseling and IPO investments.

Cons:

- The interest rate on uninvested cash is considered low when put next to some pageant.

SoFi Invest is best for new investors on the lookout for a very easy get admission to stage into purchasing and promoting with the good thing about fee-loose trades and a strong beef up software that contains financial counseling. The addition of mutual finances and get entry to to IPOs makes it a further complete platform suitable for a broader range of investment strategies.

At the time of writing, SoFi Invest was once offering up to $1,000 in free stock to shoppers who sign up by means of the mobile app. This promotion is subject to words and could be a stupendous incentive for new shoppers to find the platform.

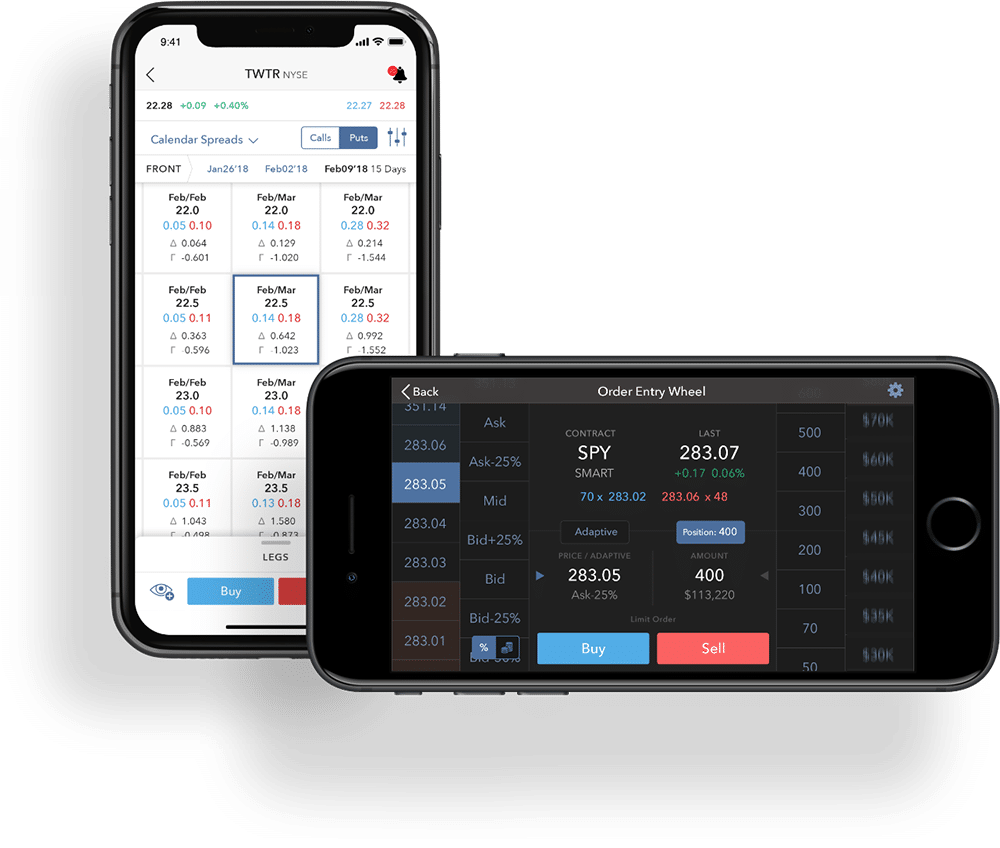

Interactive Brokers

Interactive Brokers is known for its difficult purchasing and promoting equipment and competitive fees, catering to every newbie and professional consumers. While the platform’s complexity may be bold to novices, the wealth of choices and investment possible choices can also be extraordinarily in point of fact useful to those ready to navigate its learning curve.

Key Features:

- Extensive Access to Global Markets: As one of the most important major online brokerages, Interactive Brokers provides get entry to to over 135 markets in 33 global places.

- Competitive Margin Rates: Offers one of the most a very powerful lowest margin fees within the commerce, making margin purchasing and promoting further to be had and price-efficient for consumers taking a look to leverage their investments.

- Comprehensive News Feeds and Research: This comprises actual-time knowledge, market analysis, and forecasts to have the same opinion consumers make a professional picks.

Pros:

- Competitive low purchasing and promoting fees and high hobby on cash balances.

- Broad range of investment products all over global markets.

- Low Minimum Investment Requirement.

- Access to a big selection of research equipment and belongings.

- High-quality order execution.

- No inactivity fee and low withdrawal fees.

Cons:

- The account opening process and desktop platform can also be complicated for novices.

- Customer supplier would possibly in point of fact really feel understaffed now and again.

IBKR suits full of life consumers who price a robust purchasing and promoting platform with difficult choices and competitive fees. It’s moreover a strong selection for those in world purchasing and promoting and fairly a large number of investment possible choices. Beginners would in all probability to seek out the platform complicated, then again the attainable learning curve is worthwhile for gaining access to difficult investment equipment.

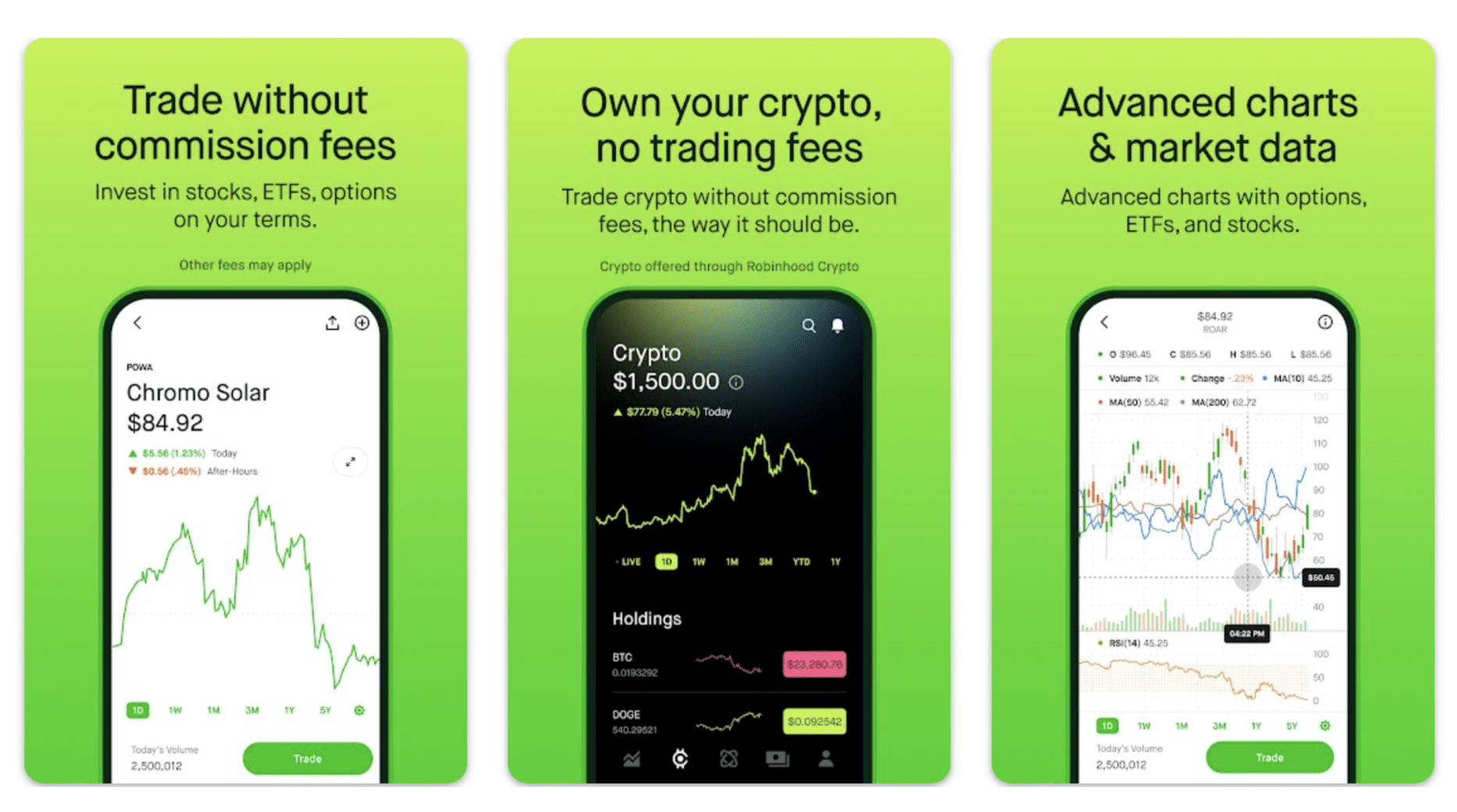

Robinhood

The one that, arguably, started it all: Robinhood was once the get admission to stage for a lot of casual consumers.

Robinhood’s option to democratizing investing has significantly impacted the brokerage commerce, prompting many to offer identical 0-fee purchasing and promoting possible choices. While it has opened the doors for a lot of latest investors, it’s essential to weigh its choices, professionals, and cons against individual investment goals and strategies.

Key Features:

- Commission-Free Trades: Robinhood is understood for pioneering fee-loose trades in stocks, ETFs, possible choices, and cryptocurrency.

- Fractional Shares: Robinhood is helping fractional share purchasing and promoting, allowing investors to buy a piece of a stock or an ETF with as little as $1.

- Great for New Investors: The platform is widely recognized for its simplicity and intuitive mobile app design, making it very consumer-pleasant for novices.

- Access to Cryptocurrency Trading: Unique among many online brokerages, Robinhood supplies the ability to make cryptocurrency trades alongside typical investment possible choices.

Pros:

- Zero commission for trades, along with cryptocurrency and possible choices purchasing and promoting.

- No minimum deposit requirement.

- Provides fractional shares, enabling investment in prime-worth stocks with a lot much less capital.

- Offers an IRA with a 1% have compatibility on contributions, encouraging retirement monetary financial savings.

Cons:

- Customer beef up is reported to be limited, which would possibly almost definitely affect user satisfaction.

- Has faced reliability issues within the earlier, along with outages and business restrictions right through dangerous market categories.

Robinhood is most in point of fact useful for new investors taking a look to dip their toes into investing without hefty fees or for purchase-and-dangle investors who prefer a palms-off, minimalist option to managing their portfolios. Its intuitive app design and simplified purchasing and promoting process can also appeal to mobile shoppers who prioritize convenience and straightforwardness of use over difficult purchasing and promoting equipment and research purposes.

The platform’s option to investment, which emphasizes ease over detailed analysis, makes it a stupendous selection for newbies then again would in all probability fall quick for those on the lookout for in-depth research equipment or a wider range of investment possible choices.

How to Invest in Stocks

Investing in stocks is an excellent way to assemble wealth over time, attention-grabbing to everyone from the passive investor to the difficult investor.

Before diving in, it’s crucial to understand the basics of the stock market and the opposite investing strategies available. One of the main steps is to make a choice a reputable brokerage supplier that aligns together with your investment goals and experience level. These platforms offer get entry to to fairly a large number of investment possible choices, along with stocks, bonds, ETFs, and IPO investing. They moreover provide essential equipment like actual-time market knowledge, which is essential for making a professional picks.

When starting your investment journey, it’s important to consider how so much you’re ready to invest. Many online brokerages now offer a low or even no investment minimum, making it easier for novices to get started.

However, it’s now not near to how so much you’re making investments however moreover the best way you’re making investments. Diversifying your investment portfolio is very important to managing chance and achieving protected growth. Whether you’re a passive investor taking a look to set and put out of your mind your investments or a sophisticated investor on the lookout for to leverage complicated strategies, there’s a place for you available on the market. It may also be in point of fact useful to seek advice from financial planners or profit from belongings provided via your brokerage to toughen your understanding of {the marketplace}.

Here are some guidelines that can assist you get began investing in stocks:

- Start Small. Begin with an amount you’re pleased with, even though it’s low, to get a in point of fact really feel for {the marketplace}. Many platforms allow purchasing fractional shares, making it easier to start out out small.

- Educate Yourself. Take advantage of educational belongings introduced via brokerage products and services and merchandise and unbiased platforms. Understanding investing strategies, market tendencies, and the mechanics of IPO investing can significantly beef up your investment picks.

- Make Use of Technology. Don’t hesitate to use apps and platforms that supply actual-time market knowledge and analytics. This allow you to make further a professional picks and stay up-to-the-minute on market movements.

- Diversify Your Portfolio. Spread your investments all over different asset classes to mitigate chance. Including stocks from quite a lot of sectors, bonds, ETFs, and even exploring IPO investing can give balanced growth.

- Consider Your Financial Goals. Align your investment choices together with your lengthy-time length financial goals. Whether saving for retirement, buying an area, or gathering wealth, your goals should have an effect on your investing strategies and chance tolerance.

Remember, investing is a marathon, now not a touch. Patience, secure learning, and staying a professional are key to navigating the stock market successfully.

FAQ

What is the best stock market app for novices?

Robinhood is likely one of the best stock market apps for beginner investors. There’s a reason why a lot of shoppers got presented to the stock market by means of it: in many ways, this app democratized stock market purchasing and promoting. Robinhood may be very fashionable for its simple interface, making it simple for newbies to business stocks or even merely buy shares of stock.

The superb app for a amateur is one that balances simplicity with the depth of choices, offering difficult equipment when the shopper is in a position to construction, all while protective a finger on the pulse of market knowledge.

How to hunt out stocks to buy?

Finding stocks to buy requires a mixture of find out about, method, and the most productive equipment. Start via defining your investing strategies and goals. Are you a passive investor looking for lengthy-time length growth, or are you further aggressive, in IPO investing or prime-volatility stocks for brief-time length sure sides? Utilize brokerage products and services and merchandise that supply whole actual-time market knowledge and complex equipment for analysis.

Mobile purchasing and promoting apps like Fidelity are renowned for their in-depth market knowledge, analytics, and educational belongings, helping investors determine promising shares of stock. These platforms allow for an intensive examination of stock potency, company fundamentals, and market tendencies. Additionally, engaging with financial planners or using educational belongings provided via the ones apps will also be providing insights into market dynamics and investment choices, guiding your determination-making process.

What are the best investment apps?

When it comes to the best investment apps, the focus is on versatility, offering a variety of products and services and merchandise from mobile platforms to difficult equipment for every novices and complex investors. Apps like Charles Schwab and Interactive Brokers excel via providing an entire investment account experience, along with get entry to to fairly a large number of investment possible choices, actual-time market knowledge, and custom designed advice from financial planners.

These platforms stand out among the finest stock purchasing and promoting app possible choices as a result of their ability to cater to a large spectrum of investment needs, from simple stock trades to finish portfolio keep watch over, all to be had by means of mobile apps for on-the-pass purchasing and promoting and investing.

What is essentially the most protected stock investment app?

The maximum protected stock investment app is one that, besides tough safety features and constant buyer reinforce, is subsidized via a reputable financial status quo. For stock consumers looking for protection and peace of ideas, apps like Fidelity and Charles Schwab are incessantly considered among the finest stock purchasing and promoting apps. They provide in depth security features, along with two-issue authentication, fraud protection products and services and merchandise, and encryption of personal and financial information. These platforms are smartly-seemed within the commerce, ensuring that buyers have a secure environment for purchasing and promoting stocks.

What is an excellent free stock purchasing and promoting app?

A good free stock purchasing and promoting app is one that combines 0 commission fees with a consumer-pleasant interface and a cast range of investment equipment. Robinhood is definitely referred to as the best stock purchasing and promoting app for those taking a look to business stocks without incurring hefty purchasing and promoting fees. It’s designed with novices in ideas, offering a easy platform for stock consumers to buy and advertise shares without the difficulty of extra costs. Additionally, Robinhood provides get entry to to actual-time market knowledge, making it a popular variety for investors on the lookout for a price-efficient and atmosphere pleasant purchasing and promoting experience.

Disclaimer: Please phrase that the contents of this text are not financial or investing advice. The information provided on this publication is the author’s opinion best and should now not be considered as offering purchasing and promoting or investing tips. We don’t seem to be making any warranties regarding the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, broker, or not unusual crypto shoppers should research a few viewpoints and be accustomed to all local rules forward of committing to an investment.

[ad_2]